How To Fl 150 Form Form Filler Online?

Easy-to-use PDF software

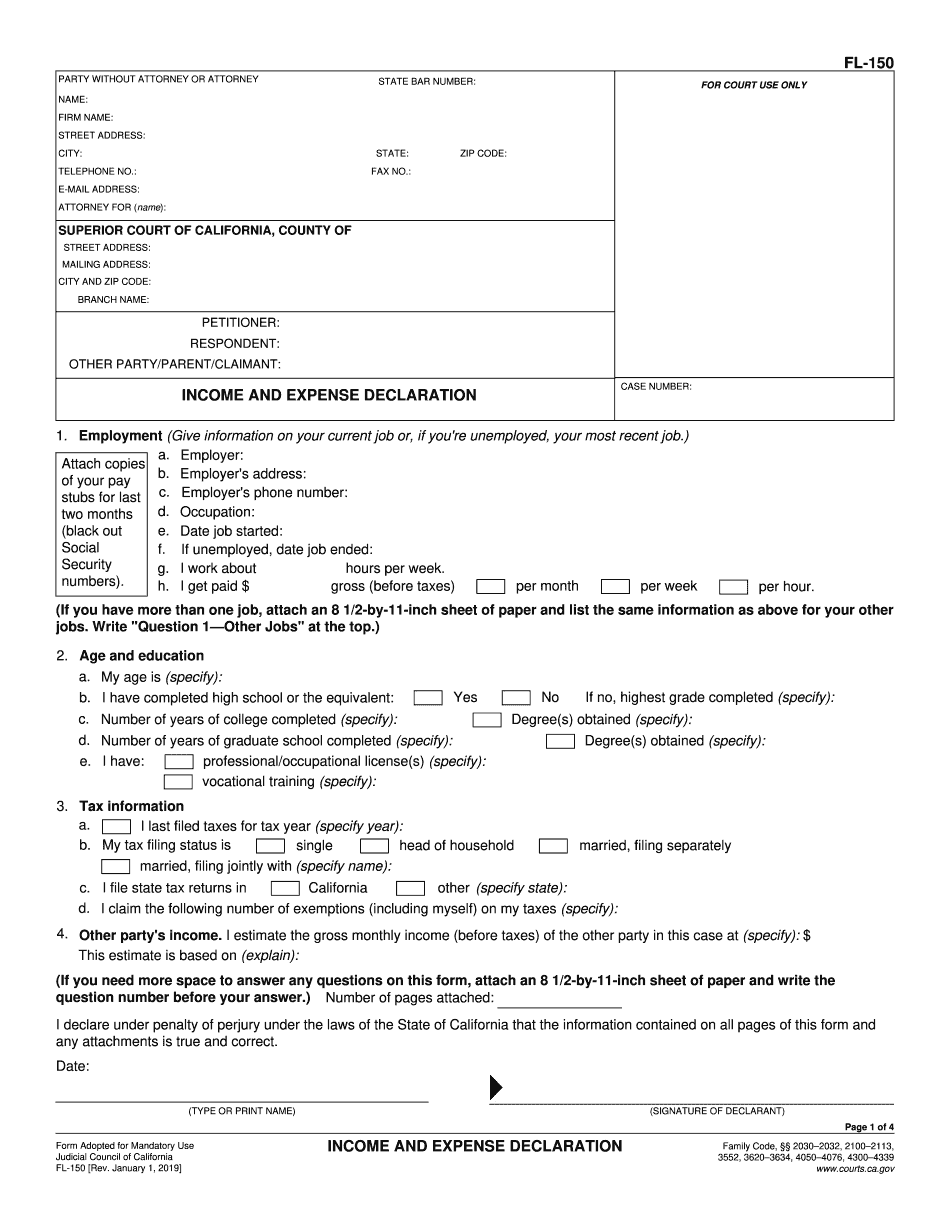

What is Fl 150 Form?

Form FL-150 is your Income and Expense Declaration where you detail everything you earn and spend, and it is completed by both petitioner and respondent. Download a copy of the form and let's get started.

How to start Form Filler for Fl 150 Form

Editing and managing PDF files look complicated. However, with our Form Filler for Fl 150 Form, you can handle it in a few clicks. A set of tools helps you insert and delete content, work on text and manage pages. The solution is web-based, so you don't have to clutter up your device's memory with another app. Visit our website from any browser and use it without a hitch.

- Open your PDF to start working on in an online editor.

- Complete the form by filling in the fillable fields or using the Text option.

- Pick a tool from the menu bar and use it in the document.

- Insert images, add annotations, place checkmarks, erase or highlight text, and so on.

- Take advantage of the Search feature to navigate the file faster.

- Place your signature and date.

- Click Done to finish the process.

Get the most out of our Form Filler for Fl 150 Form and explore more benefits to simplify your workflow. Create, complete and sign your forms seamlessly regardless of the device or operating system you use. Try out the solution now and leave all document-related issues behind.

Benefits of trying our Form Filler for Fl 150 Form

If you need Form Filler for Fl 150 Form, then our solution is for you. On the platform, you can completely edit and manage your PDF even faster and more conveniently than a hard copy. Your finished document can be downloaded, mailed, or printed. This is just a fraction of what you can do with one service. The toolkit helps you modify and work on content like a pro without installing extra software and app. Start using our solution now to check other editor's features and additional benefits of our service.

- Secure workflow

- Regular access to data

- Advanced editor

- Web-based solution

- User-friendly interface

Available from any device:

- Smartphone or iPhone

- Tablet or iPad

- Laptop or PC

Need a template of Fl 150 Form?